- SaaS Weekly

- Posts

- Why brand is a product job now

Why brand is a product job now

When growth is a trust problem, product becomes the brand builder

ISSUE #278

In the business of guiding your growth

Happy Sunday 👋

Three reads to think about this week:

Why growth is now a trust problem

The two jobs of marketing communication

The simple math to set up a sales team

Plus, the monthly Growth Series returns next Sunday. Check out last month's edition if you missed it: How to launch your funding announcement.

Let's dive in!

Ian at SaaS Weekly

SOCIAL READS

What I’m reading on LinkedIn

Is Series A the worst place to be investing right now?

The favorite B2B GTM tools – Growth Unhinge’s tech perk

A CMO admitted he’s hiding around $300k of brand spend…inside his performance marketing budget

The new SaaS onboarding: why the benchmark for "good" conversion rates looks way different

INDUSTRY OBSERVATIONS

My analysis of industry trends & perspectives

Growth is now a trust problem

Brand strategy | Elena Verna, Elena's Growth Scoop

“This is why brand is a product job now, not just a marketing job. The product itself must demonstrate trustworthiness.”

When you think about “building a brand,” you usually think about large, flashy campaigns: Super Bowl ads, billboards in SF, or thematic content via blogs and social.

It’s the wrapping around the product that creates a narrative for your audience. A “story” written internally and expressed externally – where key messaging pillars cascade across your growth channels.

[Marketing creates narrative → marketing distributes → audience tries product]

This model still works (sort of?), but the growth layer it depends on has become fragile and grim. As Andrew Chen puts it…Every marketing channel sucks right now (RIP).

Traditional marketing channels have become crowded. AI slop (those “lovely” LLM-generated blogs) has flooded Google search, making organic discovery challenging and putting pressure on paid search economics. Moreover, chatbots have reduced the value exchange between brands and an audience (i.e., ChatGPT offers the answer instead of the blog itself).

To me, what this piece does well is say the quiet part out loud. Persistent growth is less about finding the next growth channel and more about designing a company people are willing to believe in over time. Not in a brand-campaign way, but in an “I would recommend this product to someone I know” way.

With this framing in mind, trust moves upstream. It shows up in product decisions, how quickly feedback turns into updates, and whether the product earns word-of-mouth marketing instead of asking for it.

[Product builds evidence → audience forms trust → audience distributes]

I would treat this article as a reference point. Something you come back to when you’re planning your brand strategy, articulating a core pillar of your angle, or sense-checking the intuition you haven’t fully articulated yet.

Elena is a trusted voice saying what you subscribe to. And sometimes, that’s more useful than a playbook.

FROM THE TRENCHES

Perspectives from industry operators

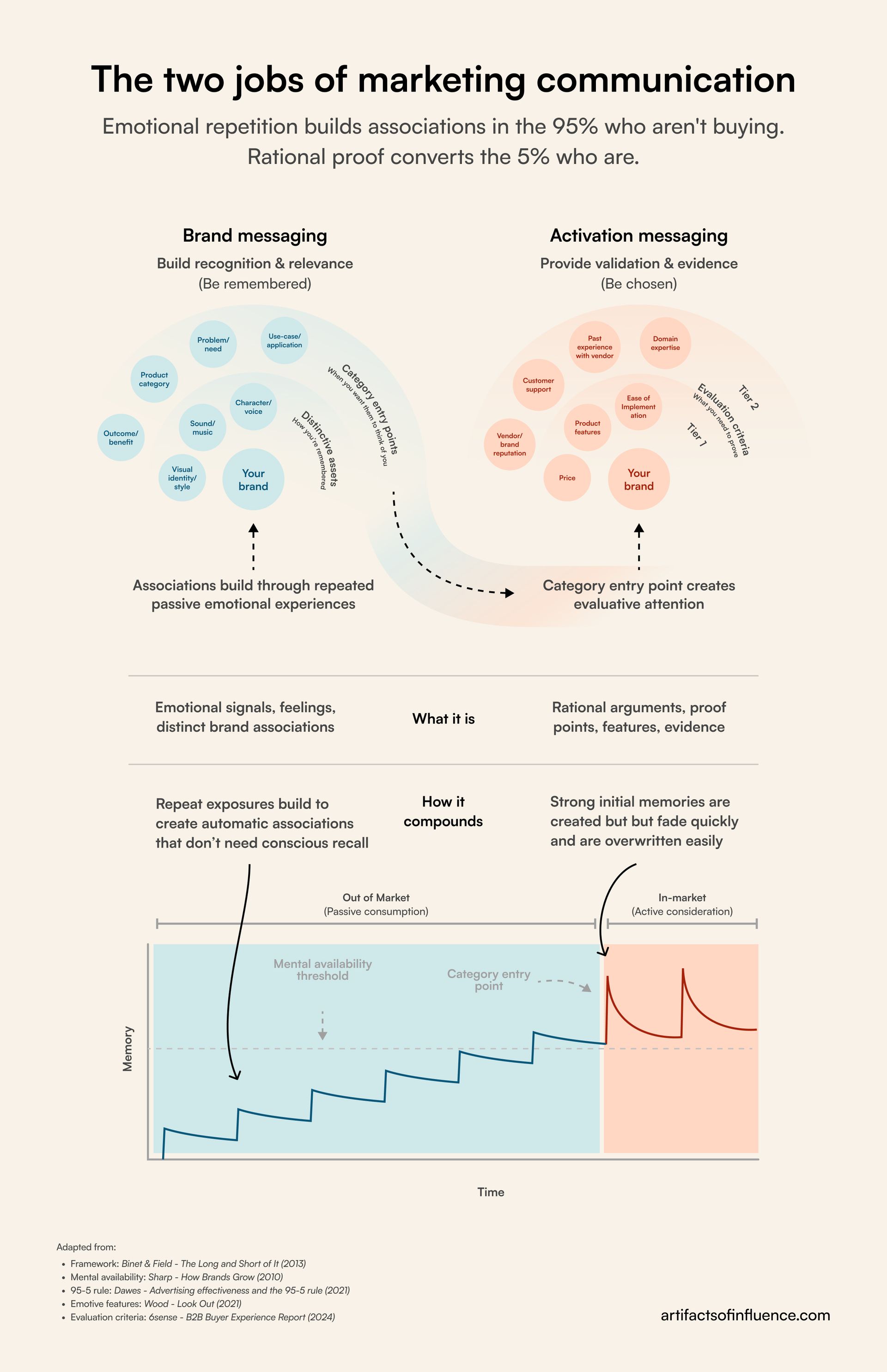

The two jobs of marketing communication

Marketing strategy | Mike Northfield, Artifacts of Influence

The switch from fact to feeling.

You’ve likely felt the pressure to "just show the product." It’s a common trap in B2B—we have a complex tool, so we assume we need to explain every feature to everyone.

In my time running short-term campaigns and evergreen programs for software companies, I’ve noticed most leadership teams over-index on rational messaging plays. Why? They’re easy to defend in board meetings, and get immediately attributable clicks. But they’re ultimately short-term plays.

The reality is that rational arguments decay quickly in our brains. To resonate with the people who are between buying cycles, you have to play the "long and short" of it. This means your messaging must shift based on who you’re talking to:

For the 5% (In-market): These people are evaluating and comparing solutions. They need facts. This is where your technical blogs, product updates, and ROI arguments live. It’s rational proof that validates their decision to choose you.

For the 95% (Out-of-market): These people are in an inattentive state. They’re not particularly interested in your API. This is where your evergreen messages, founder’s LinkedIn or high-level thought leadership should orient toward. Instead of "Gantt charts," connect your product to "the end of workplace chaos" or some larger, emotive narrative to build a feeling about your brand.

Think of it this way: Rational messaging is for response; emotional messaging is for memory.

ARTICLES TO BOOKMARK

Resources to design your next growth play

Simple math to set up a sales team

Sales strategy | David Sacks, Bottom Up

Bookmark this for when: You're building your first sales team and need to move from founder-led sales to a repeatable motion.

Why this matters: A seller’s comp plan is the foundation for building the right enterprise sales motion. Longer sales cycles, more complex products, and enterprise deals all require different incentive structures. Although it can often feel complex (too many variables), we can simplify things a bit.

Key takeaway: A seller's comp structure is made up of two variables: the base salary + the commission. The sum of these inputs gets you to the total "on-target earnings" (or OTE) for the rep, which is typically a 50/50 split between the two.

From there, you can work backwards to get to the comp structure:

Start with your sales target: say you need one rep to close $500K in ARR for the year (this is the quota)

Calculate the commissions: A standard commission rate for SaaS products is 10%, so the variable comp would be $50K

Arrive at the salary: With a 50/50 split, the base salary should also equal $50K

Total comp: this gets you to an OTE of $100K (note: sales targets should be quarterly, so take the annual figures and divide by 4)

Six variables for sales capacity planning

GTM Strategy | Jeff Ignacio, RevOps Impact Newsletter

Bookmark this for when: You're building this year's capacity plan and need to translate a revenue target into actual headcount.

Why this matters: Revenue doesn't scale linearly with headcount – reps leave, hiring takes time, ramp time is real, and not everyone hits quota. Your capacity plan should model these variables to prevent unrealistic assumptions.

Key takeaways: Whether you're running quarterly rolling plans or annual forecasts, these six factors are what align the business on what needs to happen and by when.

Recruiting: Hiring takes time and varies by role and level

Ramp: New hires are at partial capacity until fully ramped

Attainment: Not every rep hits quota – planning below 100% attainment increases the headcount required to hit a target

Attrition: assume turnover and account for backfilling

Support: Sales capacity depends on managers, SDRs, enablement, and ops, all of which scale alongside AEs

Seasonality: Revenue closes unevenly across the year, so capacity must align with buying cycles

TOP READS FROM LAST WEEK

The most clicked-on links

The education advantage in AI [Clouded Judgement]

I'm a little disappointed about AI products in GTM tech so far [Adam Schoenfeld]

Five ideas to drive upgrades [GoodBetterBest]

Was this worth reading this week? |

Thank you for reading this Sunday’s SaaS Weekly Roundup!